The economy is highly dependent on oil. But the increased oil revenues, and the governments strategy to diversify the economy, has made way for other sectors. The non-oil sector is starting to gain importance, and according to official figures the non-oil grew by 3% in real term in 2009, compared to the total real growth of 0.2 %.

Construction

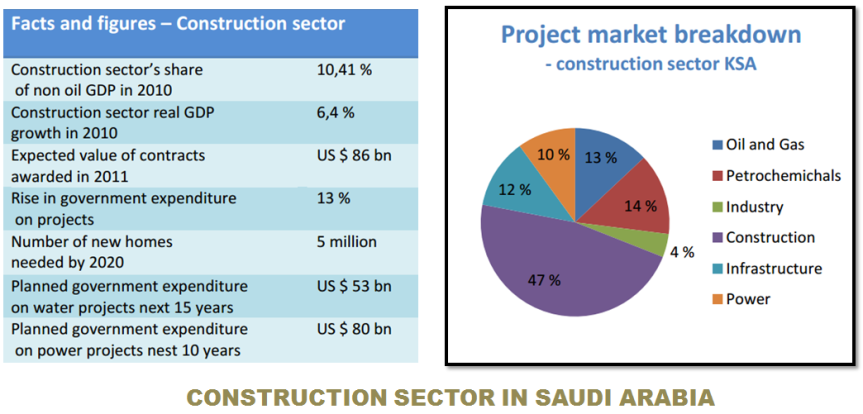

As the government keeps investing in huge infrastructure projects, the construction sector will continue to be an important part of the Saudi economy. Despite these increased budgetary allocations, the construction firms performed below what we could expect in 2009. This trend has continued in 2010. At the same time, these construction indexes making up the average for the sectors performance is only based on listed companies, and hence it does not tell the whole story. Anecdotal evidence suggests that non-listed contracting firms are enjoying a robust performance on the back of the public sector’s investment surge.

Despite these disappointing results, the construction sector’s share of the non-oil GDP will reach a historic 10% by the end of 2012. This is mainly driven by the fast growing population, expanding industrial base and heightened government spending. Contracts awarded in 2014 and 2015 are expected to reach USD 64 bn and USD 86 bn respectively. There are currently 687 planned projects in KSA, valued at USD 624 bn, 22% of which are in the execution phase.

Petrochemicals

The petrochemicals sector is the largest non-oil sector in KSA. Saudi Arabia is the world’s 11th largest petrochemicals supplier, accounting for 7-8% of total supply. While the nation’s current strengths lie in the production of basic petrochemical building blocks such as ethylene and methanol, there are plans to diversify its petrochemical portfolio into more complex, distinctive products such as specialty chemicals and engineering thermoplastics. At the same time, Saudi Arabia is investing in raising its world petrochemical market share profile to 13% by 2014.

There are already several facilities with a high level of infrastructure, such as the Yanbu and Jubail industrial city projects. These are projects developed to diversify the economy by amongst other things, making Saudi Arabia a hub for petrochemicals, not only in the region, but in the entire world. The government supports and finances a larger part of these projects and ensures continuous upgrades and the highest quality. This gives the projects the stability and the security it needs, but it remains to see whether the privatization of such projects will create the pillar for the diversification and sustainable growth the government is hoping for.

This sector is one that hasn’t been influenced by the government spending to the same extent as the construction sector. Susceptible to global economic changes, it has been highly volatile over the last year. Profits plunged in 2012 as global economic activity stalled and demand for industrial chemicals deteriorated. But as global demand, particularly from the emerging markets, has recovered, the Saudi firms have seen their profit recover.

Finance

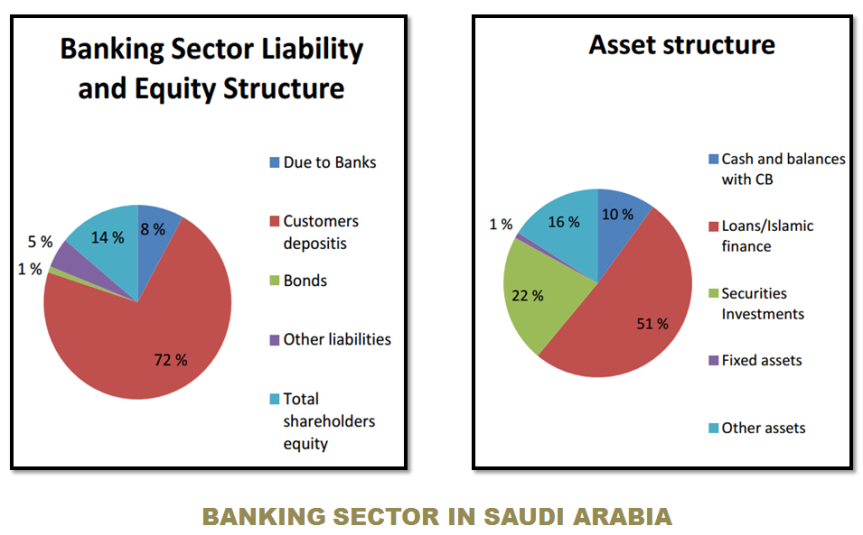

The banking sector is relatively small, with assets at around 70% of GDP at end 2013. The sector is only moderately concentrated with the three largest banks (National Commercial Bank, Samba Financial Group and Al Rajhi Bank) accounting for 45% of total assets. Public ownership (including quasi government) is fairly extensive in four banks and reaches 80% in the largest bank, the National Commercial Bank. There are five sizable specialized credit institutions with asset size close to half that of the banking sector. The country has one of the fastest growing banking markets in the Middles East, but because of the prudent regulation it remains difficult to obtain a banking license, and hence the international presence is not as large as in other parts of the region. In terms of banking assets, it ranks second in the region after UAE.

Mining and metals

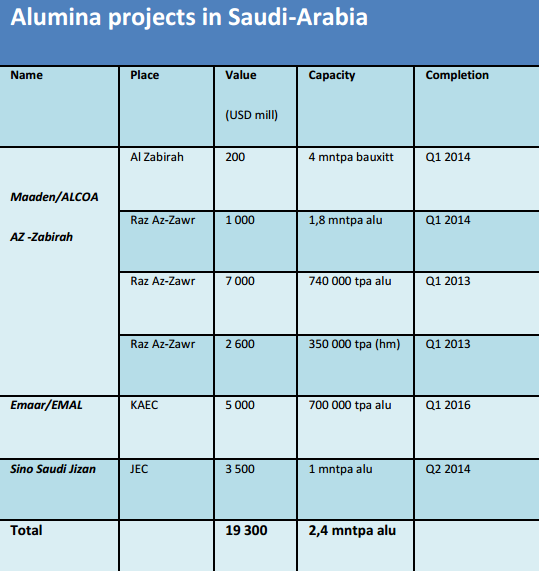

Mineral mining is set to join oil and petrochemicals as the third pillar of Saudi Arabia’s economy. The Kingdom sits upon a massive terrain, which holds huge deposits of bauxite, as well as gold, silver, lead, zinc, uranium, copper, coal, tungsten and other base metals. Efforts to exploit these extensive resources have increased, despite the long distances and lack of water.

The state controlled Saudi Arabian mining company (Madden), which was founded in 1997 to develop mining prospects jointly with private partners, operates several mines, mainly on the central plateau. Up until now they have focused on their gold mines. But they are now expanding its activities beyond the gold business with the development of its phosphate and aluminum projects. There are several new projects underway, and the sector is experiencing a massive growth. The key drivers for this growth, besides the resources itself, are the reformed mining regulation, cheap energy, and the domestic construction boom.

Energy and Environment

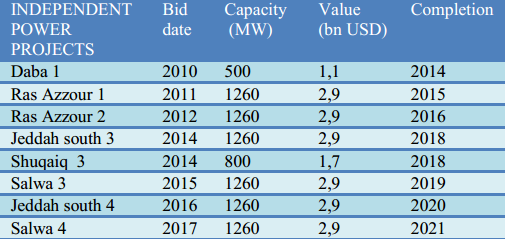

The population growth, the economic growth and the subsidized prices have led to a strong increase in the demand for power within the Kingdom. This growth is expected to continue, and as a consequence it is expected that Saudi Arabia needs to double their production capacity within 2030.

Within 2020 the energy demand is expected to reach 60 GW, and in order to meet this demand, investments of USD 20 bn has to be made. The government has announces that 20% of these 60 GW should be generated from renewable resources. In order to obtain this diversification of energy generation, it has been invested heavily in both atomic energy as well as solar energy, both in terms of research facilities and infrastructure. Mega projects such as the King Abdullah Nuclear and Renewable Energy city and Riyadh, as well as the major investments at KAUST, and more specific investments such as the poly silicon factory in Yanbu, emphasizes the government’s determination to diversify their energy production and reduce their dependence on oil.

Within 2020 the energy demand is expected to reach 60 GW, and in order to meet this demand, investments of USD 20 bn has to be made. The government has announces that 20% of these 60 GW should be generated from renewable resources. In order to obtain this diversification of energy generation, it has been invested heavily in both atomic energy as well as solar energy, both in terms of research facilities and infrastructure. Mega projects such as the King Abdullah Nuclear and Renewable Energy city and Riyadh, as well as the major investments at KAUST, and more specific investments such as the poly silicon factory in Yanbu, emphasizes the government’s determination to diversify their energy production and reduce their dependence on oil.

Source: http://vnmanpower.com